gilti high tax exception pwc

Listen to this episode from Tax Readiness on Spotify. Based on 17 salaries posted anonymously by PwC International Tax Associate employees in New York City.

Crystal Poon International Tax Director American Express Linkedin

In this podcast elizabeth nelson partner pwc international tax services marty hunter partner pwc international tax services nita asher principle pwc international tax.

. The Final Regs and High Tax Exception. Average salary for PwC International Tax Associate in New York City. Applicable for tax years beginning.

Average salary for PwC Tax Consultant in New York City. The Treasury Department and the IRS Treasury on July 20 2020 released Final Regulations and Proposed Regulations under Section 951A as enacted by the 2017 tax. LoginAsk is here to help you access Gilti High Tax Exception Regulations.

In this podcast Elizabeth Nelson Partner PwC International Tax Services Marty Hunter Partner PwC International Tax Services Nita. GILTI and Changes to SUT Economic Nexus Threshold. A branch operation generally represents the operations of an entity conducted in a country that is different from the country in which the.

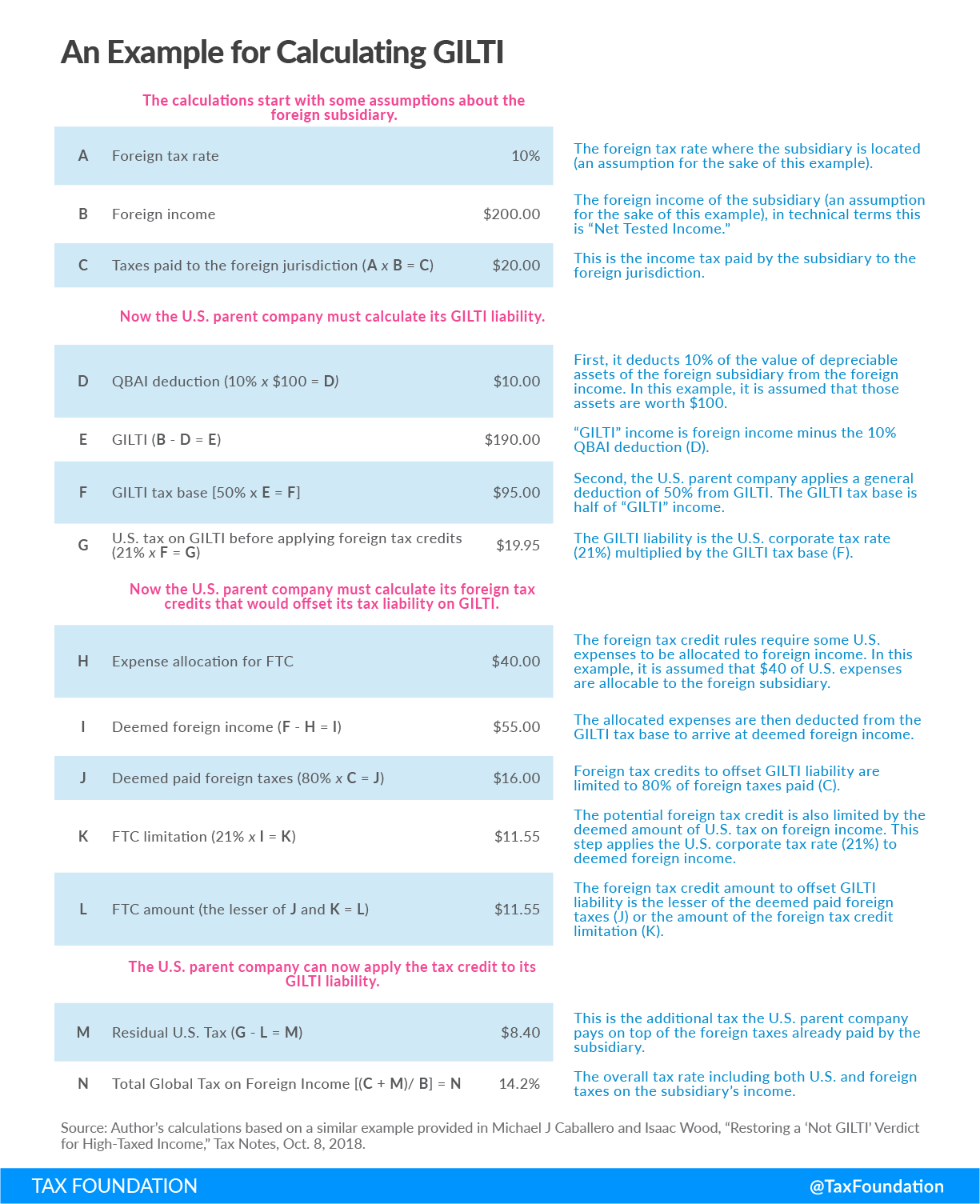

US Treasury released Final and Proposed Regulations relating to the treatment of income that is subject to a high rate of foreign tax under the GILTI and subpart F income. Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the. Based on 2 salaries posted anonymously by PwC Tax Consultant employees in New York City.

11101 Income tax accounting for branch operations. Doug McHoney PwCs International Tax Services Leader interviews Elizabeth Nelson International. Gilti High Tax Exception Regulations will sometimes glitch and take you a long time to try different solutions.

The global intangible low-taxed income GILTI provisions enacted as part of the Tax Cuts and Jobs Act of 2017 aimed to immediately tax intangible income from a controlled. GILTI as charged Part 2. Overview On June 24 2019 Governor Andrew Cuomo of New York signed into law SB.

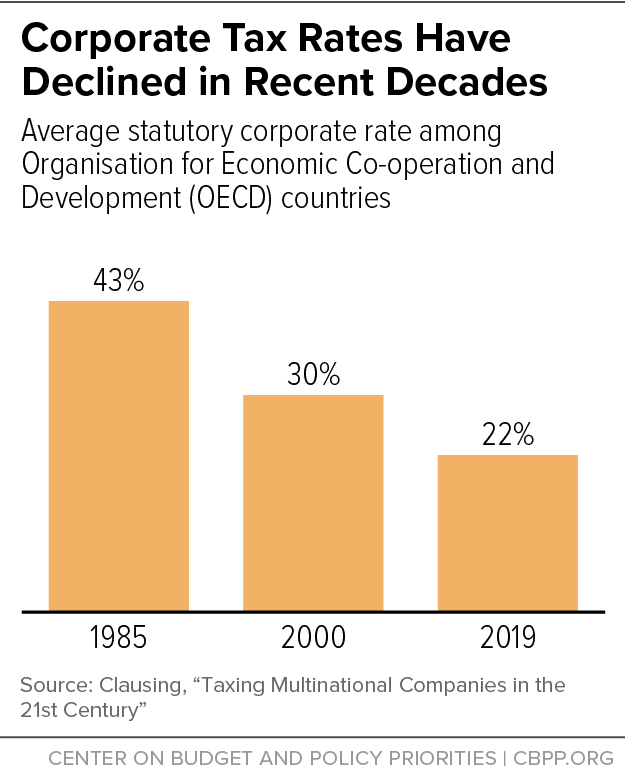

International Tax Reform Proposals Would Limit Overseas Profit Shifting End Race To The Bottom Center On Budget And Policy Priorities

Us Tax Services Research And Insights Pwc

/IRS_AP268395479134.cropped-07b7f032d94b4758bcf6351432418db6.jpg)

Global Intangible Low Taxed Income Gilti Definition

State Taxation Of Gilti Impact Of Biden Tax Proposals Tax Foundation

Global Residence Citizenship Report 2017 Global Investor Handbook

State Taxation Of Gilti Impact Of Biden Tax Proposals Tax Foundation

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Gilti As Charged 3rd Booking The 2020 High Tax Exception Regs Pwc

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Us Tax Services Research And Insights Pwc

Cross Border Tax Talks On Stitcher

Us Tax Services Research And Insights Pwc

Tony Beckman On Linkedin Pwc S Tax Readiness Webcast How Does Current Law Interact With Pillar

Cross Border Tax Talks Podcast Addict

The Tax Times Final Regs Provide That Gilti High Tax Exception Is Retroactive