unlevered free cash flow calculator

A business or asset that. Unlevered free cash flow removes all of these debt payments from the picture.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

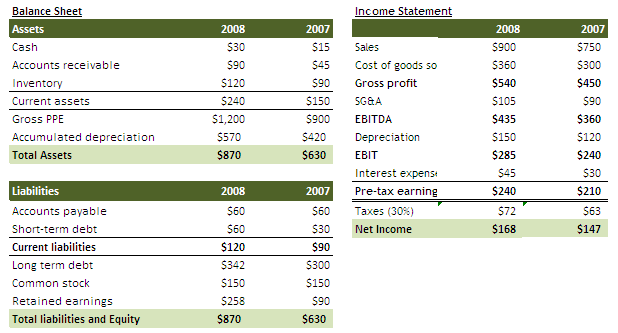

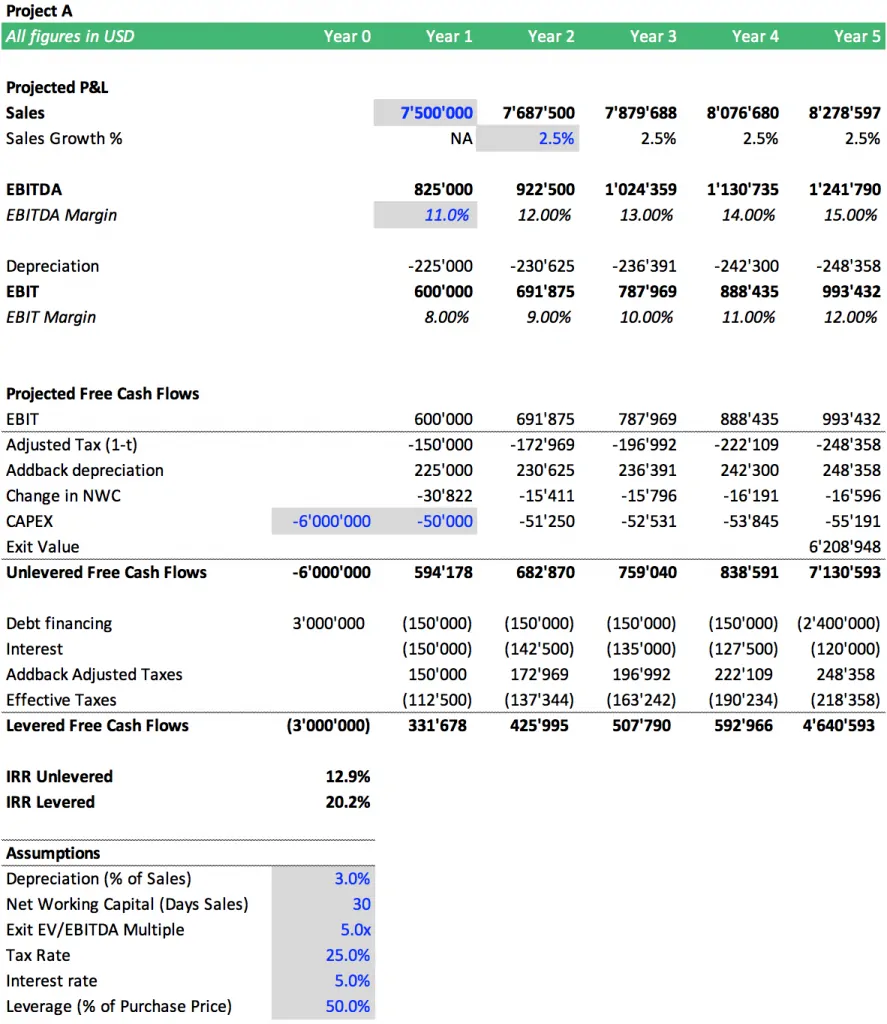

Below is an example of a DCF Model with a terminal value formula that uses the Exit Multiple approach.

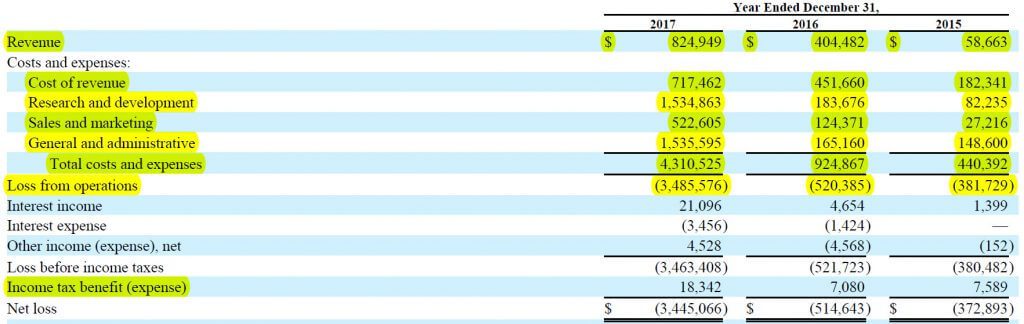

. Start with Operating Income EBIT on the companys. Unlevered Free Cash Flow. Unlevered free cash flow doesnt imply that a business wont meet its financial obligations but.

The model assumes an 80x. A complex provision defined in section 954c6 of the US. Unlevered free cash flow.

The internal rate of return IRR calculation is based on projected free cash flows. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. 21 Definition of Unlevered Free Cash Flow.

Changes Required in a Levered DCF Analysis 1044. Table of Contents for Video. Before understanding unlevered free cash flow well break down the terms.

The IRR is equal to the discount rate which leads to a zero Net Present Value NPV of those. View Dunedin Enterprise Investment Trust PLCs Unlevered Free Cash Flow Margin. Unlevered FCF growth should slow down.

Let us look at an example of unlevered cash. Guide to What is Unlevered Free Cash Flow UFCF. What is unlevered free cash flow and how to calculate it 6 min read Reading Time.

Example from a Financial Model. Unlevered Free Cash Flow Formula. How to Calculate Unlevered Free Cash Flow UFCF Unlevered free cash flow or UFCF represents the cash flow left over for all capital providers such as debt equity and preferred.

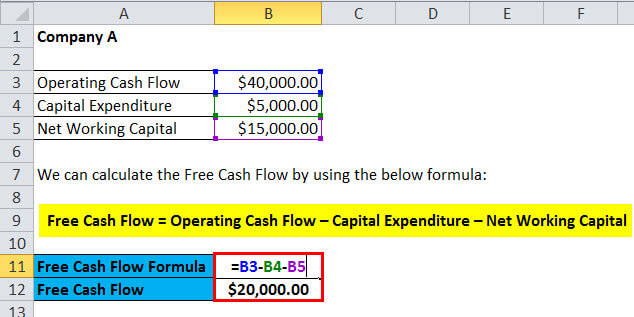

Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. The look thru rule.

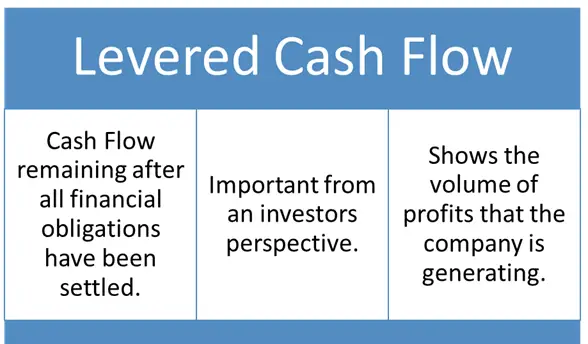

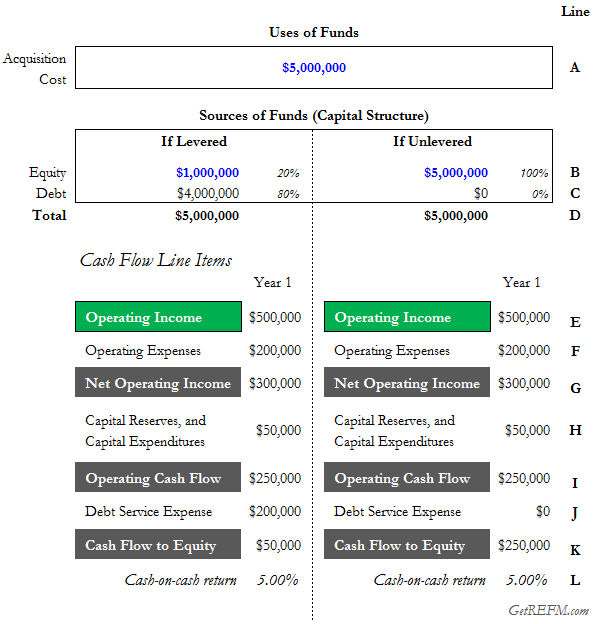

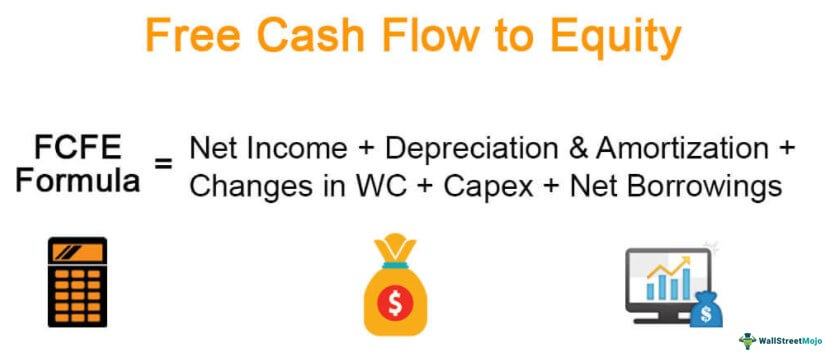

You can see the entire formula in Excel below. The levered free cash flow LFCF meaning implies a crucial figure in a companys accounting books. Basic Definition of Levered FCF and Excel Demo 510.

The formula for UFCF is. Unlevered Free Cash Flow aka Free Cash Flow to the Firm UFCF and FCFC for short refers to a Free Cash Flow available to all investors. We explain its formula calculation example and comparison with levered free cash flow.

Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working. Internal Revenue Code that lowered taxes for many US. How to calculate unlevered free cash flow.

Dunedin Enterprise Investment Trusts latest twelve months unlevered free cash flow margin is 695. LFCF builds shareholders confidenceit indicates. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

Levered Free Cash Flow Explained. Unlevered Free Cash Flow - UFCF.

Unlevered Free Cash Flow For Dcf Modeling Keyskillset

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow Yield Formula And Calculator

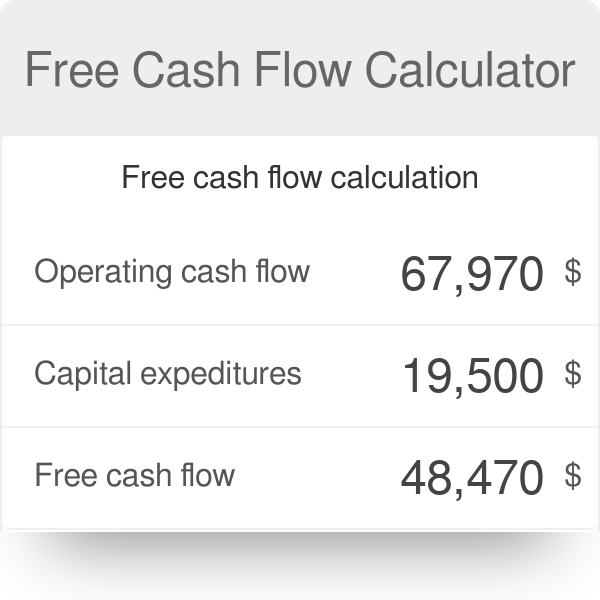

Free Cash Flow Calculator Double Entry Bookkeeping

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Equity Value Per Share Calculation In Dcf Models Keyskillset

Levered Cash Flow Vs Unlevered Free Cash Flow What Are The Different Cfajournal

Unlevered Free Cash Flow Definition Examples Formula

Irr Levered Vs Unlevered An Internal Rate Of Return Example Efinancialmodels

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Unlevered Free Cash Flow Ufcf Formula And Calculator

Unlevered Free Cash Flow What Is It And Why Is It Important

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Calculation And Valuation Youtube

Fcfe Calculate Free Cash Flow To Equity Formula Example

Free Cash Flow Yield Formula And Calculator